The Reality

It seems that every day we read how expensive housing is becoming in Niagara and beyond.

If you’re not hearing about it as you scroll through Instagram or TikTok, you might hear from your parents or relatives about how much their home is now worth, and how you should buy a house before it’s “too late”.

Because we all have $100,000 sitting in a savings account ready for a down payment, right?

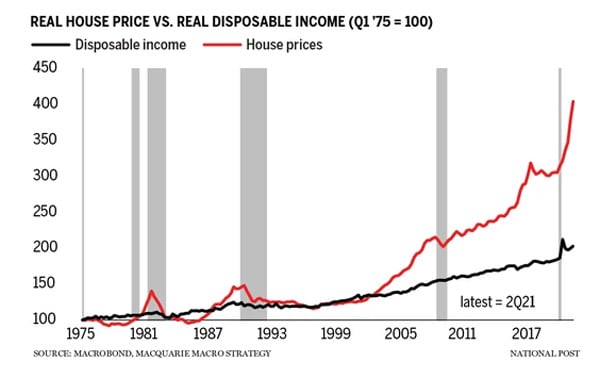

As much as Uncle Ron may have the right intention… it can be pretty discouraging when you know they aren’t truly considering the barriers to homeownership in 2022 compared to the past. Even when taking into account inflation and wages, the statistics are well documented that buying a home today is significantly more difficult.

“House prices are only going up!” Until they don’t.

As much as it's hard for young Canadians to believe because we’ve only seen house prices go in one direction, house prices can’t forever outpace inflation and wages. In fact, many economists believe that the “peak” may have happened in early 2022 and statistics show prices are actually easing in Niagara, primarily as a direct result of rising interest rates.

Canada isn’t the first country to have a housing boom. Some notable housing booms include:

- Japan in 1990. Japanese real estate is finally reaching its 1990 prices about 30 years after its initial decline.

- United States in 2008. The 2008 recession caused United States real estate to fall an average of 33% from 2006 peak prices, and it took until 2016 to make up the decline. Even then, prices remained 20% below 2006 prices when accounting for inflation.

The point of these stats isn't to make you want to guess the best time to buy a house in Canada. They simply illustrate that house prices can go down, and just because we haven't seen this in recent Canadian history, doesn't mean we are magically immune to volatility.

So instead of focusing on the past. How do we best plan for buying a home in the future?

Moving forward. Strategies to get approved for your mortgage.

- Set up a savings plan. You will need a minimum down payment of 5% of the purchase price of a home. However, the more you can put down, the lower your mortgage will be. An advisor can work with you to figure out how much you will need to set aside each month to save up enough for a down payment and closing costs. Not only that, they can provide different investment options to help you reach your desired savings goal.

- If you are fortunate enough to have family that’s in a position to help out, gifted down payments are becoming increasingly popular with the rise in housing prices. A gifted down payment must come from an immediate family member, who “gifts” the buyer money to assist with the down payment. The money is gifted with no intention of having to be re-paid – think of it as an early inheritance.

- Many borrowers look at adding a co-signer to their mortgage. Having a co-signer typically strengthens your mortgage application and may allow you to borrow more than you would qualify for on your own. There are many factors involved when considering a co-signer, be sure to talk to an advisor to see if this option is right for you.

- Reduce your debt. Did you know that any debt you have, for example, vehicle loans, credit cards, etc. will affect the mortgage amount that you qualify for? Work at paying down any existing debt you have. Avoid financing large purchases while you are trying to get approved for a mortgage. For example, you don’t want to take out a big car loan while trying to qualify for a mortgage.

- Go through a high-ratio insurer. If you have less than 20% down, you will be required to go through a mortgage insurer such as CMHC or Sagen. They have different qualifying rules, and the good news is buyers will often qualify for a higher mortgage amount than with a traditional conventional mortgage. There are pros and cons to going through an insurer, be sure to speak to an advisor to see if this option is right for you.

- Check your credit score. When trying to get approved for a mortgage, one of the first thing lenders will look at is your credit score, which is used to determine your ability to repay your debt. The higher the score, the better. In addition to showing creditworthiness, a higher credit score also allows you to get a lower interest rate, which means a lower mortgage payment!

These are some general strategies to help you get approved for a mortgage. Be sure to talk to an advisor who can offer more comprehensive advice based on your unique situation!

Not financial advice. For entertainment purposes only.

Apply for your mortgage today below: